capital gains tax changes 2020

We spoke with Suzanne Graham a Chartered Certified Accountant and Partner at Hollis Accounting based in Edinburgh about the proposed changes and what they could mean for you. Based on the capital gains tax brackets listed earlier youll pay a 15 rate so the gain will add 300 to your tax bill for 2020.

What You Need To Know About Capital Gains Tax

RULES FROM 6 APRIL 2020 From 6 April 2020 within 30 days of completion of sale it will be necessary to submit a provisional calculation of the gain to HMRC and pay the tax that is due.

. Arkansas Tennessee and Massachusetts will each see reductions in their individual income tax rates. HMRC made several changes to the Capital Gains Tax regime specifically in relation to properties effective from 6 April 2020. Currently any capital gains tax is recorded on an individuals personal tax return and tax is payable on 31 January following the end of the tax year the 5 April.

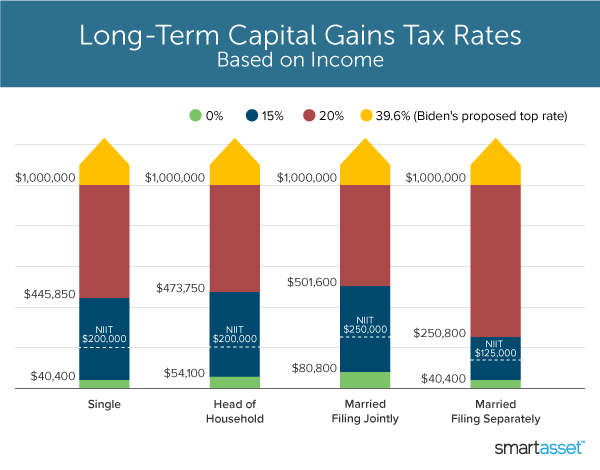

500000 of capital gains on real estate if youre married and filing jointly. Capital Gains Tax changes April 2020 1. However which one of those capital gains rates 0 15 or 20 applies to you depends on your taxable income.

The IRS typically allows you to exclude up to. The capital gains tax CGT system could be made simpler and fairer by reducing the annual exempt amount and raising rates to match income tax according to a recent report from the Office of Tax Simplification OTS. The changes affect the Capital Gains Tax CGT reporting deadlines and the amount payable when an individual sells a residential property that they have not used as their main home such as a holiday home a buy-to-let property or a.

18 and 28 tax rates for individuals the tax rate you use depends on the total amount of your taxable income so you The court can address changes in custody parenting time and support. Capital Gain Tax Rates. Changes due 6 April 2020 New rules for Capital Gains Tax on property sales comes into force from 6 April 2020.

In 2018 the IRS significantly reduced the Form 1040 completely revising the previous traditional version and introducing additional programs that transmit information to the Form 1040 although the IRS has not changed Form 1040. Previously it was not necessary to report or pay CGT until you submitted your. 9 hours agoThe following Capital Gains Tax rates apply.

Firstly what is Capital Gains Tax. Following the Finance Act 2019 the new Capital Gains Tax Return Reporting regime came into effect on 6th April 2020. The main changes that were made to Capital Gains Tax were regarding the deadlines for paying it after selling a residential property in the UK.

To help you get up to speed heres an overview of whats happening. At the moment if the property that you are disposing of was once your main residence. This comes after Chancellor Rishi Sunak asked the OTS to carry out comprehensive review of the capital gains.

The higher your income. 401 k income limits. Five states Iowa Kansas Maine North Carolina and Ohio will see notable changes to their individual income tax bases.

What were the Capital Gains Tax changes. We want to flag it to you now due to the tight time constraints attached to the change in Capital Gains and the way it is recorded. Since 6th April 2020 if youre a UK resident and sell a piece of residential property in the UK you now have 30 days to let HMRC know and pay any tax thats owed.

In 2022 individuals under the age of 50 can contribute 20500. Capital Gains Tax. This is up from 19500 in 2021.

PPR Relief last 9 months. 250000 of capital gains on real estate if youre single. Get ready for changes to Capital Gains Tax payment for UK property sales The deadlines for paying Capital Gains Tax after selling a residential property in the UK are changing from 6 April 2020 -.

The last few years have seen a number of changes to the UKs tax regime with the latest coming into force on April 6th 2020. Payable within 30 days. Its also worth noting that if.

The tax rate on most net capital gain is no higher than 15 for most individuals. Tax Changes for 2013 - 2020 - People with high incomes will be subject to a higher capital gains rate of 20. Corporate income capital stock franchise.

These will affect those with second homes and buy to let properties. New timings to pay tax due The biggest. The 2019 to 2020 tax year is the last year UK residents will be required to pay the Capital Gains Tax for the sale of properties as part of.

Thirty-five states have major tax changes taking effect on January 1 2020. IRS Restores Capital Gains Tax and Other Tax Return Changes for 2020 Ready or not the tax return changed again during the 2020 tax season. Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for single or 80800 for married filing jointly or qualifying widower.

PPR relief is.

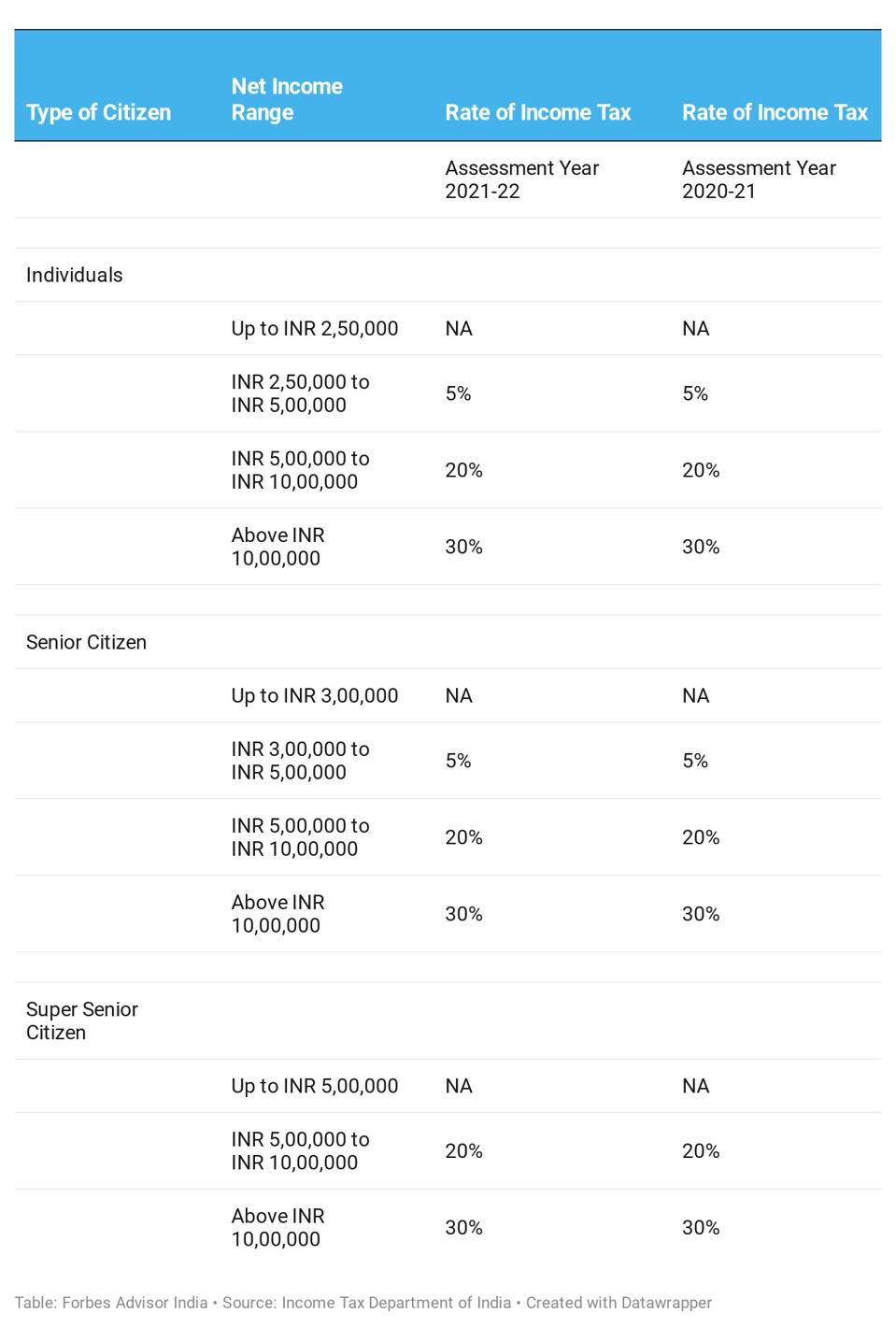

Know Types Of Direct Tax And Charges Forbes Advisor India

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

The States With The Highest Capital Gains Tax Rates The Motley Fool

What S In Biden S Capital Gains Tax Plan Smartasset

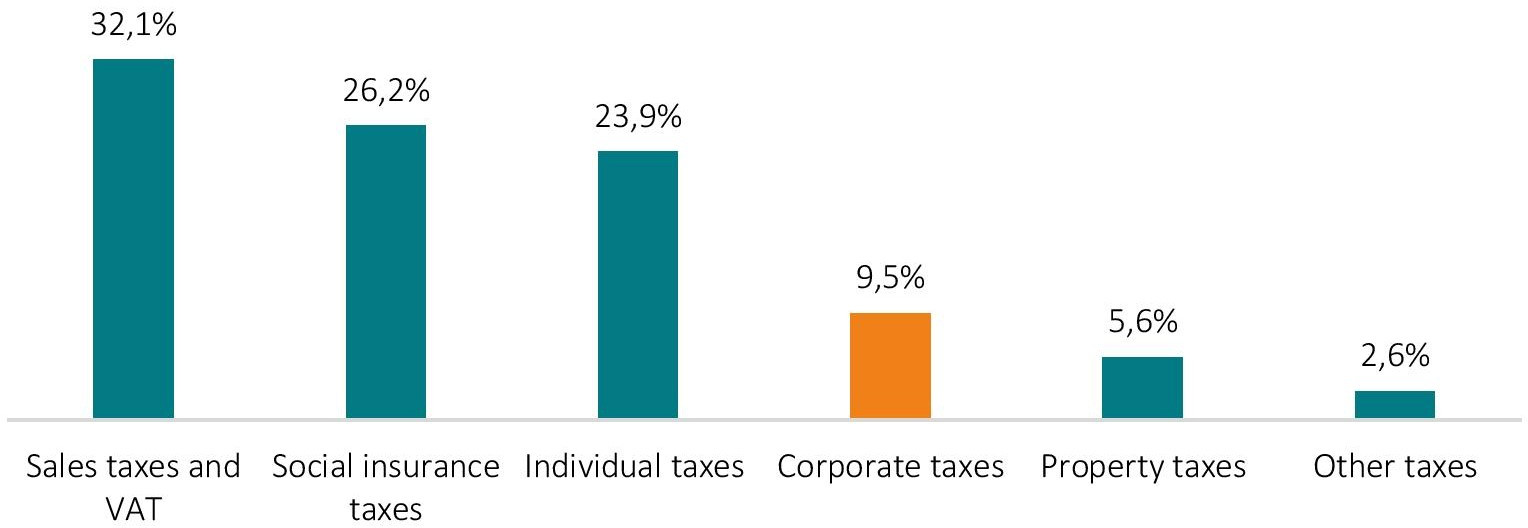

Mandatory Tax Filing Who S Obligated To File Tax Returns Taxfix

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How Do State And Local Individual Income Taxes Work Tax Policy Center

What You Need To Know About Capital Gains Tax

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

How High Are Capital Gains Taxes In Your State Tax Foundation

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax What Is It When Do You Pay It

A 95 Year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

What You Need To Know About Capital Gains Tax

State Corporate Income Tax Rates And Brackets Tax Foundation